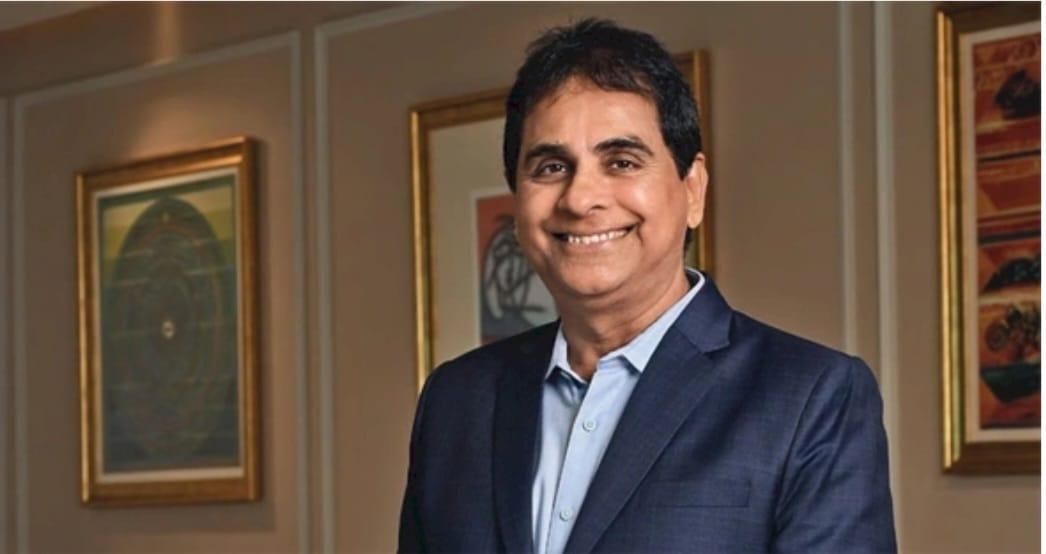

MUMBAI: Stress tests conducted by RBI suggest that Indian banks are at their healthiest point in more than a decade, with bad-loan ratios expected to improve further in the coming months and all banks retaining adequate capital even under extreme stress. According to the Financial Stability Report (Dec 2025), the banking system could withstand a sharp deterioration in macroeconomic conditions. Under the baseline scenario, which assumes growth and inflation broadly track current forecasts, capital adequacy ratios ease only marginally by March 2027, while asset quality improves further, with gross NPAs projected to decline to 1.9% from 2.2% in Sept 2025. “The health of the scheduled commercial banks (SCBs) continued to remain robust with strong capital and liquidity buffers, improving asset quality and stable profitability,” the report said, adding that “stress tests results reaffirmed the resilience of banks to withstand losses under adverse scenarios and maintain capital buffers well above the regulatory minimum.” “Maintaining financial stability and strengthening the financial system remains our north star. But financial sector regulators recognise that financial stability is not an end in itself,” RBI governor Sanjay Malhotra said in a foreword to the Financial Stability Report. “Promoting innovation and growth, protecting consumers, and a pragmatic approach to regulation and supervision that improves financial system efficiency are equally important.” Malhotra warned that global vulnerabilities remain elevated, saying that while the world economy was more resilient than anticipated, “the outlook for 2026 and beyond is shrouded in uncertainty as the contours of policies that are reshaping the global economic landscape remain fluid and untested.”

RBI: Banks healthiest in decade, can bear shocks