India and the United States (US) on February 7 announced a framework for an Interim Agreement on reciprocal and mutually beneficial trade, positioning the pact as a commercial breakthrough and a strategic realignment amid deepening geopolitical rivalry and global supply-chain disruptions.

In a joint statement by the White House and India’s Ministry of Commerce and Industry, both governments said the interim deal would reaffirm their commitment to a broader US-India Bilateral Trade Agreement (BTA) launched by the US President Donald Trump and Prime Minister Narendra Modi on February 13, 2025, and support more resilient, diversified supply chains at a time of rising trade tensions with major partners, particularly China.

Current tariff landscape: steep levies reset

Before the interim framework, US tariffs on Indian goods had climbed as high as 50 per cent for many products, one of the steepest rates imposed on any trading partner, following a baseline 10 per cent duty, a 25 per cent “reciprocal” tariff and an additional 25 per cent punitive levy tied to India’s earlier Russian oil purchases.

Under the new interim agreement, the US has agreed to reduce its overall tariff on Indian exports to about 18 per cent, rescinding the previous 25 per cent punitive tariff and focusing on reciprocal duties calibrated to market access and security interests.

Before the reset:

-

Most Indian exports faced combined duties of up to 50 per cent, including textiles, gems and jewellery, chemicals and auto parts, with some additional duties pushing effective rates even higher on certain products such as marine goods.

After the interim pact:

Tariff concessions and reciprocal commitments

Under the interim framework, India has agreed to eliminate or reduce tariffs on all US industrial goods and a broad range of American agricultural products, including dried distillers’ grains, red sorghum for animal feed, tree nuts, fresh and processed fruit, soybean oil, wine and spirits, among others.

In return, the US cut tariff barriers on Indian exports to a level intended to reflect a more balanced trade relationship. Beyond the headline 18 per cent rate, certain strategic sectors such as pharmaceuticals, energy products and critical minerals remain exempted from punitive levies, reflecting their importance to both economies.

India: balancing market access with domestic protections

For India, the interim framework provides expanded access to the US market at a time when exporters, especially in textiles, leather, gems and select manufactured goods, had been under heavy tariff pressure. The agreement aims to lower India’s average tariffs on US goods (which in some cases pre-deal were in the mid-to-high single digits or higher, depending on the product) as part of a broader liberalisation drive.

Agricultural tariffs: a sharp shift from protection

Agriculture is among the most politically sensitive areas covered by the interim trade framework, and the commitments mark a notable shift from India’s traditionally protectionist tariff regime on farm products.

Under the interim trade framework, India has committed to eliminate or substantially reduce tariffs on these products and other US agricultural exports, including oilseeds, feed ingredients and processed foods. The joint statement said detailed, product-wise tariff schedules would be finalised during the implementation of the Interim Agreement.

By comparison, US tariffs on agricultural imports are generally low, typically in the 0-10 per cent range for most farm products. US officials indicated that Indian agricultural exports would continue to benefit from these relatively low rates as broader reciprocal tariffs are recalibrated under the interim framework.

Before the interim agreement, India imposed high import duties on several US agricultural products. Tariffs on tree nuts such as almonds, walnuts and pistachios typically ranged between 30 per cent and 50 per cent, while fresh and processed fruits faced duties of around 30-40 per cent. Soybean oil imports were subject to tariffs of roughly 15-30 per cent, and dried distillers’ grains (DDGs) and red sorghum used for animal feed attracted duties of about 15-25 per cent. Wine and spirits faced some of the highest barriers, with effective border duties often 50 per cent or higher, excluding additional state-level taxes.

The tariff reductions are expected to expand US agricultural exports to India, but they remain politically sensitive domestically, given concerns around farmer incomes, price stability and food security.

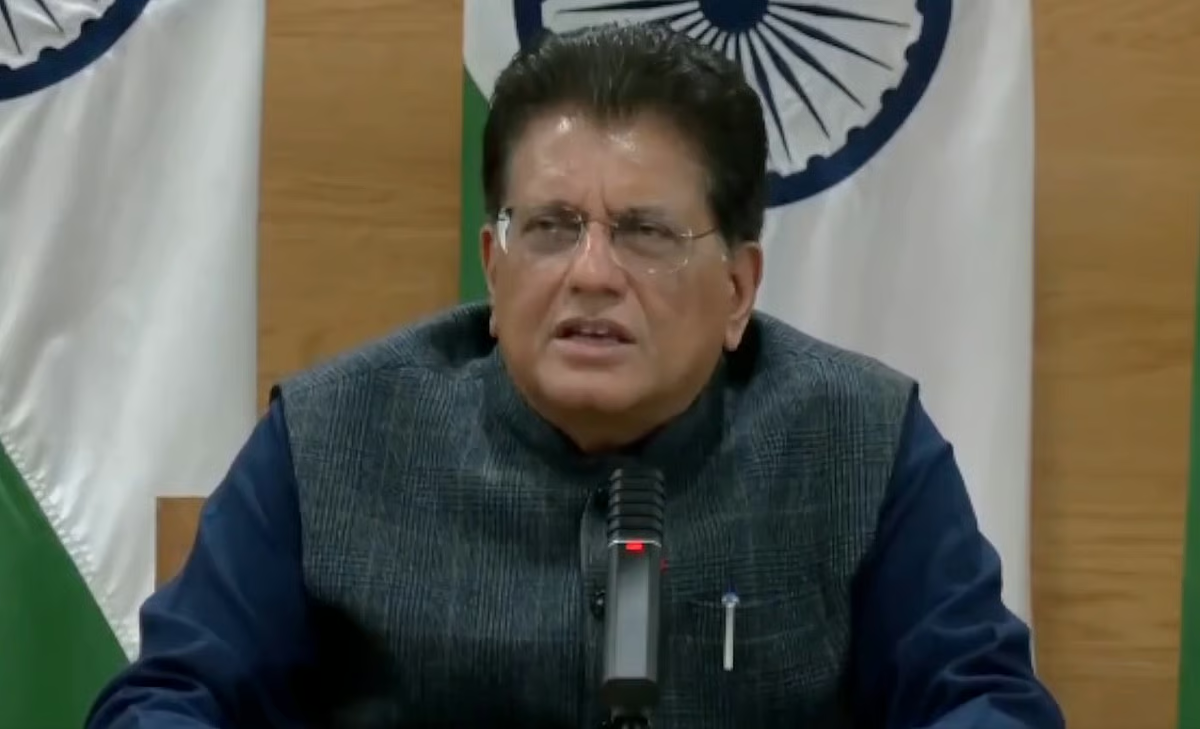

Addressing reporters on India-US BTA on February 7, Union commerce minister Piyush Goyal Goyal emphasised that the India-US interim trade agreement was carefully designed to protect Indian farmers and sensitive agricultural sectors, even as tariffs were reduced elsewhere. According to him, India ensured explicit exemptions for a wide range of agricultural and food products to safeguard domestic livelihoods.

He told reporters, “We have been able to safeguard sensitive sectors and balance our farmers’ sensibilities by fully protecting and ensuring carefully drafted exemptions for several agricultural products.”

“Products such as meat, poultry, dairy items, GM food products, cereals, millets like jowar, bajra and ragi, oilseeds, fruits, pulses and animal feed have been kept outside the agreement,” he added.

“This agreement will give a huge impetus to farmers and fishermen while ensuring their interests are fully protected.”

Metals, minerals and critical materials: tariffs, trade and the energy transition

Metals and minerals are strategically significant in the interim pact, given their role in defence and clean-energy technologies. While US tariffs on Indian steel, aluminium and copper had previously reached around 50 per cent, the new framework eases some of these pressures in exchange for broader cooperation on critical inputs.

India will also receive preferential tariff quotas on automotive parts, providing leeway for integrated supply chains. The pact intentionally keeps critical minerals such as lithium, rare earth elements, copper and nickel tariff-neutral, reflecting both countries’ interest in securing diversified sources for electric vehicles, renewable energy, batteries and advanced electronics supply chains.

Goyal said the US and India are part of a US-led initiative aimed at developing alternate sources of critical minerals.

The initiative focuses on building resilient supply chains to ensure uninterrupted availability of critical minerals for industry and economies worldwide, and “we are confident that like-minded trading countries participating in it will significantly strengthen these supply chains,” he said.

Automobiles and auto parts: easing barriers in a sensitive sector

Automobiles and auto components are among the most strategically sensitive areas covered by the interim trade framework, given their importance to manufacturing jobs, export earnings and evolving electric-vehicle supply chains in both countries.

Under the interim framework, the United States agreed to grant India a preferential tariff-rate quota for automotive parts covered by national security tariffs, easing access for Indian component manufacturers supplying US. automakers while retaining US security safeguards.

India, in turn, has committed to provide preferential market access to US auto and component exports as part of the broader agreement. Prior to the deal, India’s import duties on completely built passenger vehicles were among the highest globally, often 60-100 per cent or more, depending on engine size and vehicle type, while auto components typically attracted duties in the 10-15 per cent range.

Before the interim framework, Indian exports of automobiles and auto parts to the United States faced a mix of most favoured nation (MFN) duties and national security tariffs. While US MFN tariffs on passenger vehicles are relatively low at 2.5 per cent, auto parts have been subject to additional measures under Section 232 national security provisions, creating higher effective barriers and uncertainty for Indian suppliers integrated into US automotive supply chains.

While the interim framework does not immediately dismantle India’s high tariffs on fully built vehicles, it signals a gradual opening for auto parts and clean-mobility segments, which are expected to be key negotiating areas as talks move towards a comprehensive Bilateral Trade Agreement.

Non-tariff barriers and regulatory cooperation

In addition to tariff changes, India agreed to address non-tariff barriers affecting US medical devices and ICT goods, reduce restrictive licensing procedures and consider acceptance of US or international standards for imports within six months of the agreement’s entry into force.

Both sides also committed to ongoing discussions on standards and conformity assessment procedures to improve supply-chain predictability and reduce compliance costs.

Energy, technology and economic security

The interim framework places energy and advanced technology cooperation at the centre of bilateral economic security. India said it intends to purchase $500 billion worth of US energy products, aircraft and aircraft parts, precious metals, technology products and coking coal over the next five years, emphasising a strategic shift in procurement priorities.

Both countries also pledged to expand trade in technology products, including graphics processing units (GPUs) and other critical components, to support data centre growth and technological innovation, alongside deeper joint technology cooperation.

The joint statement further emphasised economic security alignment, including coordination on investment screening, export controls and responses to non-market policies of third countries, implicitly referencing concerns over China’s state-backed industrial policies.

China trade dynamics: tariffs and competitive shifts

Geopolitical tensions with China have influenced both the US tariff strategy and India’s positioning. Under US reciprocal tariff policy announced in 2025, China faced higher effective US tariffs (around 34 per cent under the same regime that had earlier put India at 26 per cent), and in some reporting scenarios, additional punitive duties have pushed overall levies much higher on select Chinese goods.

That has created a competitive window for India, as higher tariffs on Chinese exports can make Indian products more price-competitive in US markets, particularly in categories like apparel, minerals, electronics and plastics.

Digital trade and next steps

On digital trade, India and the United States agreed to address discriminatory or burdensome practices and to work toward robust, mutually beneficial digital trade rules as part of the broader BTA, an area that has previously seen friction over data governance and localisation.

Both governments said they would promptly implement the interim framework and work towards finalising the Interim Agreement, with the stated goal of concluding a comprehensive BTA consistent with the Terms of Reference agreed during BTA negotiations.

“The India-US Trade Deal marks a pivotal step forward in advancing economic synergy between two of the world’s largest democracies. This strategic partnership is designed to lower tariffs, ease regulatory bottlenecks, and unlock new opportunities across sectors. As India strengthens its position as a global manufacturing hub, this agreement offers a timely boost to competitiveness, technology access, and supply chain resilience. It’s a moment to accelerate value creation—for India, with India, and from India—at a truly global scale,” said Federation of Indian Chambers of Commerce and Industry President Anant Goenka.