The report highlighted the government’s front-loaded capital expenditure push, with capital spending rising 32.4 per cent during April–October FY26, even as revenue expenditure growth was tightly contained at 0.026 per cent during this period.

It said that although there may be some revenue sacrifice due to income tax and goods and services tax reforms during the current fiscal year, some unbudgeted additional receipts under non-tax revenues and some reduction in the budgeted magnitude of revenue expenditures may still enable the Centre to adhere to the budgeted targets for fiscal deficit and capital expenditure.

The report also noted that Parliament has recently passed the Central Excise (Amendment) Bill, 2025, and the Health Security and National Security Cess Bill, 2025. These measures impose additional taxes on tobacco and pan masala and are expected to support revenue enhancement, it said.

Negative contribution of net exports

The EY Economy Watch report also expects the contribution of net exports to real GDP growth to remain negative and possibly increase in its magnitude.

In Q2FY26, the negative contribution of net exports was (-)2.1 percentage points, rising from (-)1.4 percentage points year-on-year. This impact may continue till trade related uncertainties dissipate, it added.

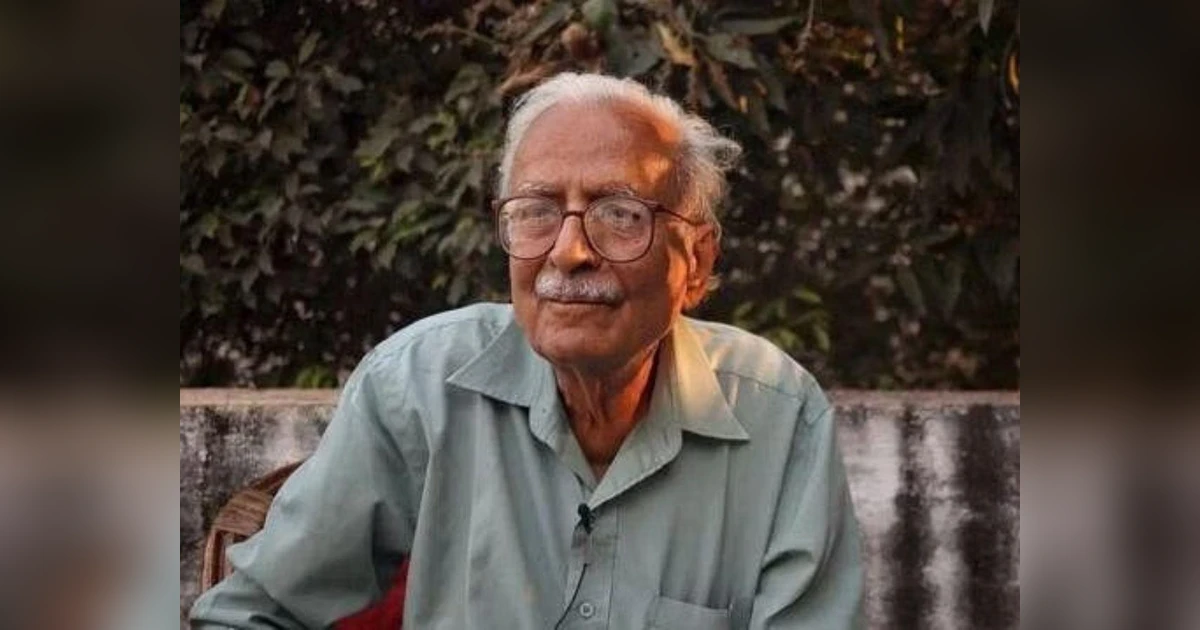

Looking ahead, EY said domestic demand is likely to remain a significant anchor of growth as global trade conditions stay volatile. “Thus, going forward, India may have to continue to rely on its resilient domestic demand to support growth. Along with RBI’s growth-oriented policy, one can look forward to a complementary growth push through the Union Budget for FY27,” said DK Srivastava, chief policy advisor at EY India.

The consultancy added that adherence to the fiscal consolidation path, while sustaining capital expenditure growth in the range of 15–20 per cent annually, would be crucial for maintaining medium-term growth of around 6.5 per cent.

“This would facilitate maintaining a robust medium-term growth profile with an average growth of 6.5 per cent which would be further supported if domestic private investment growth also gathers momentum and global supply chain issues ease off,” he added.

Indian economy expanded by 7.8 per cent and 8.2 per cent in the first and second quarters of FY26, respectively. The RBI has projected GDP growth of 7.3 per cent for the current fiscal year, up from 6.5 per cent in 2024-25.