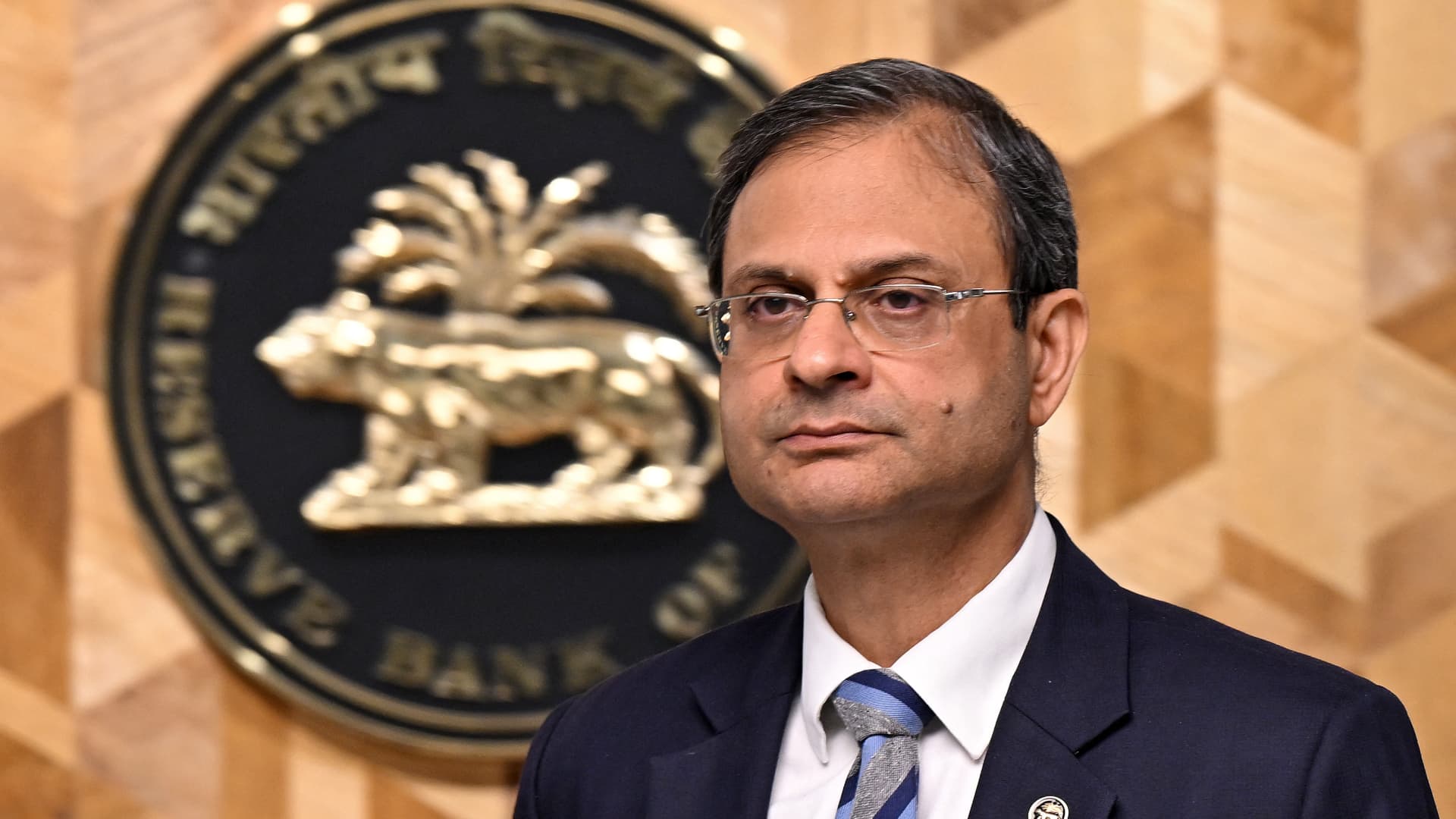

Newly appointed Reserve Bank of India Governor Sanjay Malhotra after addressing a press conference, in Mumbai on Dec. 11, 2024.

Indranil Mukherjee | Afp | Getty Images

India’s central bank on Friday kept its policy rates steady, as trade deals with the E.U. and the U.S. are set to support the world’s fastest growing large economy.

Economists polled by Reuters had forecast the policy rate to remain unchanged at 5.25%.

“External headwinds have intensified, though the successful completion of trade deals augurs well” for overall economic outlook, said Sanjay Malhotra, governor of Reserve Bank of India, explaining the reason for hitting a pause on the easing cycle.

He added that in the near term, domestic inflation and growth outlook remain positive.

“Guidance was balanced, suggesting a prolonged pause is likely going forward,” said Radhika Rao, senior economist and executive director at DBS Bank Singapore in an emailed response.

The Reserve Bank of India cut benchmark rates by 125 basis points last year, and economists say the focus will now shift to transmission of the previous rate cuts.

Malhotra said the RBI “will remain proactive in liquidity management” and ensure sufficient liquidity in the banking system “to meet the productive requirements of the economy” and to facilitate monetary policy transmission.

“We expect open market operations this quarter and the next,” Rao of DBS Bank said.

The RBI will likely hold rates for at least a year, Santanu Sengupta, chief India economist at Goldman Sachs, told CNBC’s “Inside India.” There was an “outside chance of a rate cut,” if the U.S.-India trade deal had not gone through, he added.

Earlier this week, U.S. President Donald Trump announced that Washington will cut tariffs on Indian exports to 18%, dispelling the central bank’s worries around external headwinds to growth it had flagged in the last policy meet.

The U.S. had levied 50% tariffs on India, amongst the highest across countries and more than on China with which it has had an adversarial relationship, souring ties between New Delhi and Washington.

The RBI will focus on transmission of rates as the yields on long-term bonds are “unlikely to come off,” said Sengupta, as banks and insurance companies taper their buying of long-term government securities coupled while the supply of bonds is rising.

India will borrow 17.2 trillion rupees ($187 billion) in the financial year starting April 1, Finance Minister Nirmala Sitharaman said in her budget speech on Sunday. This figure marks an increase of 18% from the revised estimate for financial year 2026 and was higher than market estimates.

In its December policy meet, the RBI cut interest rates by 25 basis points to 5.25% in a unanimous decision, citing “weakness in some key economic indicators.”

According to India’s economic survey, released just days before the U.S.-India deal announcement, the country’s economy is expected to grow by 7.4% in the fiscal year ending March 2026, and between 6.8% and 7.2% the following year. That puts India on track to keeping its crown of being the world’s fastest growing large economy.

The RBI has little to worry on the inflation front too. India’s consumer inflation rose to 1.33% in December, slightly accelerating from 0.71% in the prior month. The central bank expects inflation for the current financial year at 2.1%, up from 2.0% forecast earlier.

The food supply prospects “remain bright” in the near term, the RBI said in a release, adding that even core inflation was expected to remain in range, excluding volatility caused by prices of precious metals.