Europe’s fintech map often focuses on the power centers: London, Berlin, Amsterdam, and Paris. Yet some of the most advanced payment infrastructure and operational discipline in the region emerged not from the largest markets, but from three small Baltic states that were early to see how technology could reshape financial services.

The Baltics built a fintech environment ahead of much of Europe by being practical, fast, and collaborative. Regulators acted as partners, digital infrastructure went live early, and teams learned to scale across borders long before the rest of the continent realized how essential that mindset would become. These advantages were the result of design choices that global fintechs still struggle to replicate.

How the Baltics built an agile and disruptive fintech environment

The regulatory decisions that gave Estonia, Latvia, and Lithuania their head start were straightforward and bold. Digital IDs became a foundation for instant onboarding at a time when most European markets still relied on paper processes and in-person verification. At the same time, regulators launched sandboxes before the rest of the EU even used the term consistently, and licensing was structured for speed and clarity rather than endless rounds of interpretation.

Operationally, this meant startups could launch products fast, since instant settlement rails removed friction that other markets still battle. And, through e-residency, these countries lowered the cost of formation and cross-border operations. As a result, a founder could sip coffee in Riga and register a company in Tallinn without waiting months for approval, and then open accounts, integrate payments, and onboard users in days rather than weeks.

There is a myth that Baltic regulators were lenient. They were not. They were collaborative. They preferred open dialogue to adversarial oversight, and they invested in understanding technological risk rather than blocking it by default. Western Europe often misreads this as permissiveness when it is really precision. The Baltics learned to balance innovation and supervision without slowing movement.

The lessons that scale are evident in the form of structured sandboxes, lean licensing, digital identity infrastructure, and interoperable payment rails. The lesson that does not scale is cultural speed. Expecting Germany or France to adapt at the pace of Estonia is unrealistic. However, the underlying principles remain transferable.

Small markets, global mindset: Why Baltic fintechs scale faster

Growing up in a small, saturated market forces founders to think globally from day one. In the Baltics, the size of the domestic customer base makes hyperlocal strategies unviable. Companies must design products that can operate across multiple jurisdictions because there is no other path to meaningful scale.

This shapes behavior early. Teams build multi-currency, multilingual, multi-entity infrastructures before their first thousand customers. They learn to anticipate regulatory differences between markets instead of retrofitting processes later, and become skilled at launching across borders in synchronized waves because they have no choice.

Western European teams often underestimate the complexity of this. Localization is not adding a language toggle. Multi-jurisdictional operations require flexible processes that can absorb regulatory variations, reporting differences, and distinct user behaviors without breaking. Baltic fintechs develop this resilience at the beginning, not during crisis moments later.

However, challenges still exist. Expanding abroad requires constant adaptation, especially in marketing, compliance, and integration with local banking partners. But Baltic teams tend to be battle-tested. They treat complexity as a default condition rather than a surprise.

Operational discipline is the secret advantage

The real Baltic edge is operational discipline. After working within larger banking teams, I can say the difference is stark. Baltic fintechs run lean and precise operations almost by instinct. Processes are built to be consistent and scalable. There is little room for unnecessary friction because the teams are small and the goals are ambitious.

Streamlined compliance is a prime example. This does not mean lax, by the way. It means building systems that meet regulatory standards without slowing product development. Baltic teams understand how to maintain strong governance while removing procedural bloat. They integrate risk, reconciliation, onboarding, and oversight into workflows that are clear and predictable.

Cross-border operations shape leadership, too. Managers think in systems rather than silos. They learn to anticipate friction in advance, whether related to reporting, currency flows, or platform interoperability. This mindset helps them avoid mistakes common in global fintechs, such as underestimating reconciliation complexity, misreading local regulatory nuances, or ignoring geopolitical constraints embedded in cross-border payments.

Operational discipline is not an add-on in the Baltics. It is embedded in the culture, and it is what allows small teams to launch products across ten or more markets while maintaining regulatory confidence.

What global players can actually adopt

If global fintechs want to borrow from the Baltic model, they should begin with their mindset. Build for compliance, scale, and cross-border complexity from the start. In small markets, this is survival. In large markets, it should be a strategic discipline.

Several practices are immediately exportable. For instance, we could start with sandboxes that encourage collaboration rather than confusion, lean licensing, digital ID infrastructure, instant payment rails, and operational processes that balance speed with governance. These create an environment where innovation moves quickly without losing regulatory oversight.

The difficulty lies in culture and structure. Large fintechs and incumbent institutions often operate within legacy systems and rigid risk frameworks. Speed becomes impossible not because teams lack ability, but because the underlying architecture resists change. Large markets have complexities (size, legacy infrastructure, political layering) that inherently slow down change. The problem is not incompetence but structural constraints.

Regulators in big markets can also learn from the Baltic approach. Structured dialogue, clear guidance, and pilot programs create more innovation than rulebooks that take years to interpret.

Looking ahead, I expect global markets to adopt real-time payments, digital onboarding through verified identities, and integrated multi-entity platforms within the next three to five years. Much of this is simply the Baltic playbook applied at a larger scale.

Final thoughts

The Baltic payments revolution was the product of regulatory foresight, cultural pragmatism, and operational discipline. These markets built environments where fintechs could move quickly while maintaining strong governance, and the result is a region that continues to punch above its weight in global financial innovation.

Large markets do not need to replicate the Baltics. They need to understand what made the region effective, which is clarity, collaboration, and the confidence to build systems for the world rather than only for their own borders. The most successful global fintechs of the next decade will be those that adopt this mindset early, and build accordingly.

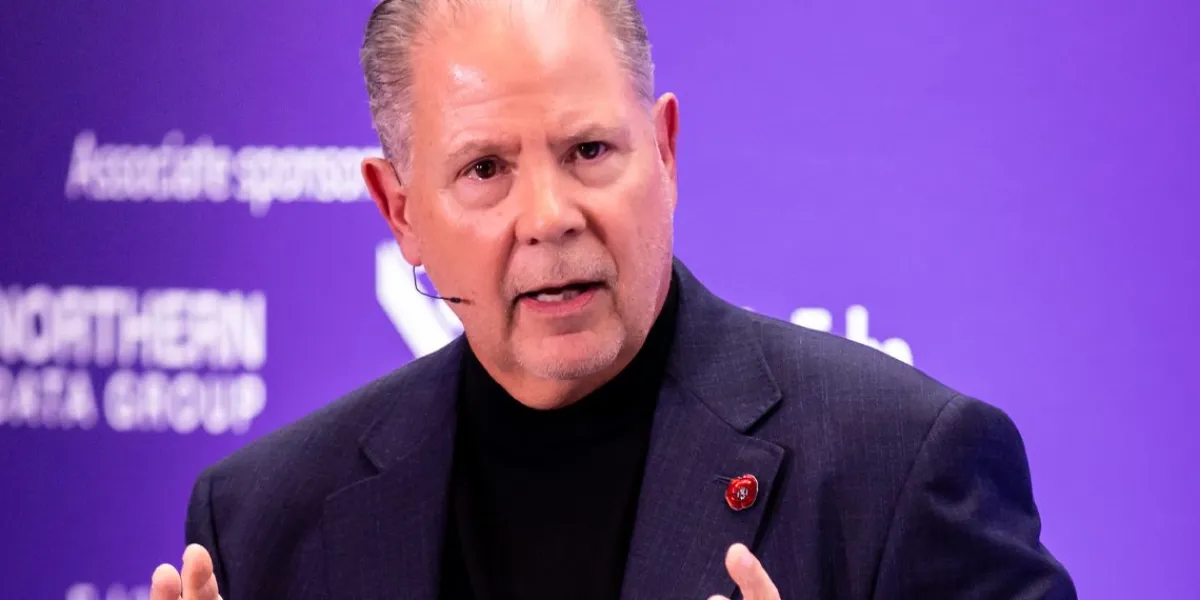

About the Author

Nikita Zelezkins is the Chief Operating Officer at Noda, a seasoned finance professional and operational strategist with extensive experience in international banking, financial management, and cross-border team leadership. Earlier in his career, he held senior roles within a major Latvian banking group across several European jurisdictions, where he oversaw key operational and financial processes.