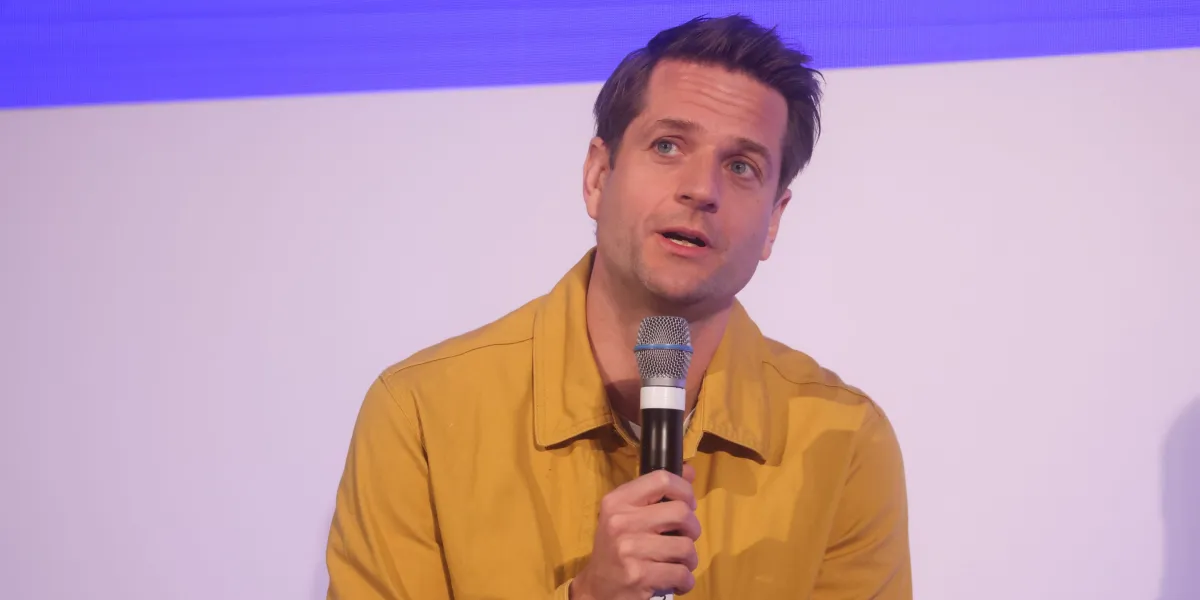

David HendersonScotland news correspondent

PA Media

PA MediaA £150m support package has been announced for the Grangemouth industrial complex.

The UK government will invest £125m and owners Ineos will contribute £25m to support 500 jobs at the site.

Scottish secretary Douglas Alexander told the BBC the joint deal was a “stark contrast” to the closure-hit Mossmoran chemical plant.

He criticised ExxonMobil for lack of investment in the Fife site, which is due to close in February with the loss of up to 400 jobs.

Grangemouth is the UK’s last ethylene plant, a key ingredient in plastics used in advanced manufacturing and the automotive and aerospace industries.

In addition to ethylene, the plant’s core products are propylene, polyethylene, and polypropylene.

These materials are used in a wide variety of products, including packaging, insulation, cables, construction materials, pharmaceuticals and healthcare products, including PPE and syringes.

The complex uses shale gas brought in by ship from the United States to produce ethylene.

Prime Minister Sir Keir Starmer said the deal would protect jobs and ensure places like Grangemouth can develop into the future.

He said: “Our commitment is clear; to back British industry, to stand by hardworking families, and to ensure places like Grangemouth can thrive for years to come.”

PA Media

PA MediaThe UK government said that £75m in finance was provided by NatWest and the government has underwritten this by providing a guarantee.

The government said it was providing the remainder of the funding via a grant, to take the total to £125m, with Ineos providing equity to make up the remainder of the £150m total.

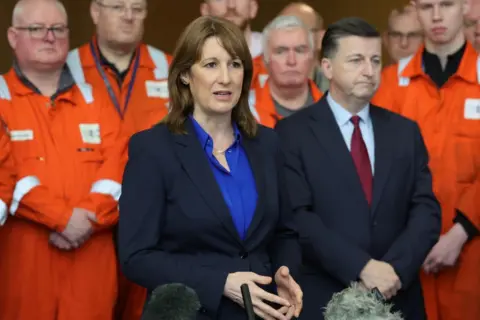

Chancellor Rachel Reeves visited the plant following the announcement, along with Alexander and Business secretary Peter Kyle.

Reeves said: “Building on the millions of pounds we’ve already invested in Grangemouth, this vital package protects our national resilience and secures the livelihoods of hundreds of people employed at the site way into the future.”

The site stands next to the Grangemouth oil refinery.

In April, it stopped processing crude oil and moved to being an import terminal for finished fuels, with the loss of 400 jobs.

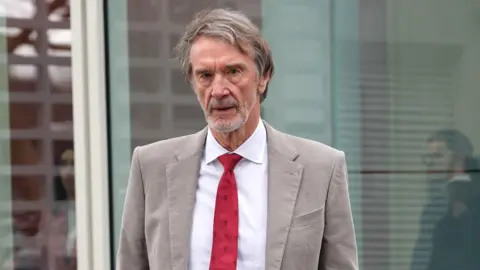

In January, the Ineos chairman Sir Jim Ratcliffe warned the chemical industry was coming to an end in Britain due to high energy costs and carbon taxes.

He said the new investment package demonstrated Ineos and the UK government’s commitment to British manufacturing.

“It protects 500 high-value jobs, secures supply chains, and preserves the industrial capacity the nation needs,” he said.

“The support of the UK government is welcome as we work to deliver competitive and efficient low-carbon manufacturing for the UK, long term.”

PA Media

PA MediaGrangemouth community councillor Steven Aitkenhead told BBC Scotland’s Lunchtime Live that the news was a “glimmer of hope.”

He said: “Grangemouth itself is experiencing huge social difficulties at the moment and could be classed as a social emergency.

“So this news that securing and safeguarding jobs in the town is very welcome, of course.

“We hope that all the opportunities that come to the town through the Just Transition improves the lives of people who live in Grangemouth and the local area.”

‘Strategic significance’

Scottish Secretary Douglas Alexander told the BBC’s Radio Scotland Breakfast programme that the UK government was “determined to protect chemical production in Grangemouth”.

He said: “This petrochemical facility is of strategic significance, not just to Scotland, but to the whole of the UK.

“It is a critical element of the supply chain to a whole range of industries.”

In recent months there has been concern about the future of the UK petrochemical industry because of the rising cost of energy.

Last month, ExxonMobil announced plans to close part of the Mossmorran chemical plant in Fife, impacting 179 directly employed jobs and 250 contractors.

The company said the high cost of energy at the plant, which also produces ethylene for the plastics industry, was partly to blame for the decision.

The UK government has warned that high energy costs have caused problems for the chemicals industry across Europe.

It said about 40% of ethylene gas capacity has either closed recently or is at risk of closure.

Getty Images

Getty ImagesAlexander criticised ExxonMobil’s leadership and said there had been a “stark contrast in the dialogue and discussions” over the future of the Mossmoran site.

He said: “When we sat down with Jim Ratcliffe it was pretty clear what was needed in order to be able to deliver a future for the chemical facility in Grangemouth.

“There had been significant Ineos investment in the plant.

“In contrast, the Mossmorran facility is now 40 years old, it was built to have a 20 year lifecycle.

“Alas, there hasn’t been the scale of investment that many of us would wished to see in Mossmorran over recent years.

“The management were not able to give us a pathway to profitability.”

parliamentlive.tv

parliamentlive.tvExxonMobil chairman Paul Greenwood has previously partly blamed UK government policy for the decision and said there was no “competitive future” for the site.

Mr Greenwood told the Scottish Affairs Committee on Wednesday that the current environment was “very difficult” to operate in the UK at the moment.

Douglas McAllister MP asked Mr Greenwood if the new investment announcement on Grangemouth “flew in the face” of that view and if Jim Ratcliffe and others were experiencing the same environment he described.

Mr Greenwood agreed, but added: “If you stand back and you look at the facts, I think you turn around and you say, Prax refinery has shut. Grangemouth refinery has shut. Fife ethylene plant has shut.

“The government has now effectively had to inject some money and capital into another chemical plant in order to keep it operating.

“I think those are signs of an industry that’s struggling, not signs of an industry that’s thriving.”

Mr Greenwood said Exxon Mobil had invested £270m into the Mossmorran site over the previous five years, but had made a £300m loss over the same period.

PA Media

PA MediaGiving evidence to the same committee, Bob McGregor, industrial officer for the Unite union, disagreed that Mossmorran was not commercially viable.

He said: “The plant is one of the youngest ethylene plants in Europe, it has a dedicated workforce.

“Yes, it needs investment, but I’m sure that investment could come from a company who’s making £25bn, the third best year in the history of their business.

“We certainly hope that both governments get behind the call to extend that date of closure further into the future to allow a real look at the viability of that site, whether it’s an ethylene plant, or whether it’s something else.”

Mr McGregor said that there had been “a lot of kind words and soundbites”, but said he had not seen “any real tangible evidence” of support from either government.

‘Much-needed boost’

The UK and Scottish governments have been scrambling to reduce the impact of recent job losses in the chemicals sector.

They made a joint commitment to supporting a green energy hub at Grangemouth, on part of the site left vacant by the refinery closure.

The Scottish government welcomed the new investment.

Climate and energy secretary Gillian Martin said: “The Scottish government has been calling upon UK government for months now to intervene to protect jobs at Grangemouth and Mossmorran at a scale seen in other parts of the UK.

“This news will give a much-needed boost to Grangemouth community and the workers at Ineos.”

Future profits

In her budget last month, chancellor Rachel Reeves announced £14.5m for Grangemouth to support a transition to low carbon and renewable industry on the site.

But the UK government has been accused of failing to deliver £200m pledged to Grangemouth from the National Wealth Fund.

Unions representing workers at Grangemouth have accused both governments of doing too little, too late.

With the Scottish Parliament election coming in May, senior Labour ministers have been keen to ensure the future of this key industrial site was not in doubt.

Ineos has agreed assurances that funding will only be used to improve the site and allowed the government a share in future profits.

The firm said it had spent more than £100m maintaining operations at the site over the past year.