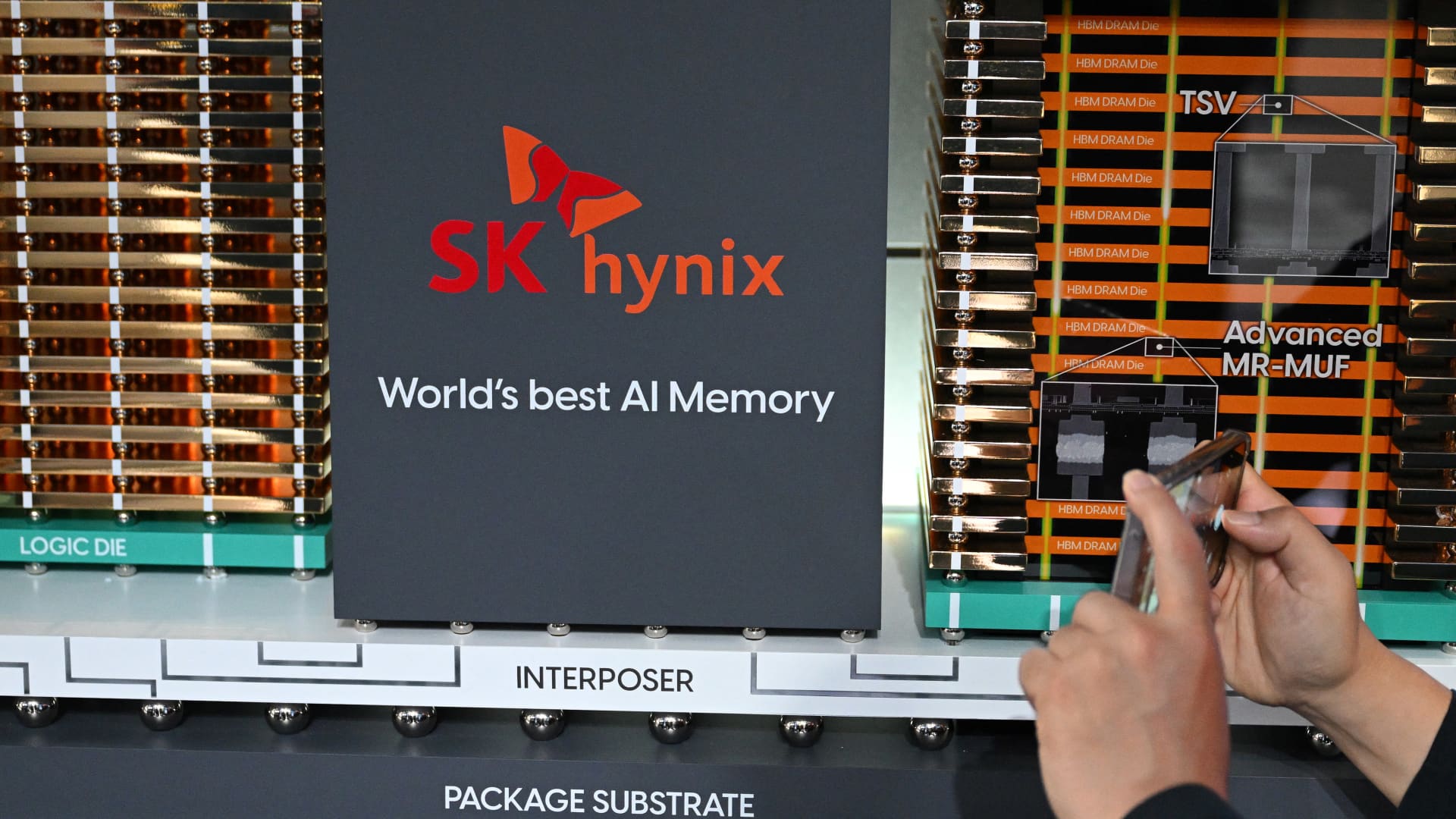

A visitor takes a picture of a model of SK hynix’s high-bandwidth memory (HBM) technology during the 2025 World IT Show in Seoul on April 24, 2025.

Jung Yeon-je | Afp | Getty Images

South Korea-based memory maker SK Hynix announced Tuesday it will invest 19 trillion Korean won ($12.9 billion) to build a new advanced packaging plant, as it expands production to meet rising demands tied to artificial intelligence.

The new facility will be located in the Korean city of Cheongju, building on the company’s existing footprint there. Construction is set to begin in April, with completion targeted for the end of 2027, the firm said in a statement.

The plant will focus on advanced packaging, which involves combining multiple memory chips into a single, high-density unit to improve performance and energy efficiency while reducing overall size.

SK Hynix is among the world’s largest producers of memory chips and leads in so-called high-bandwidth memory (HBM), which is used in artificial intelligence processors, including those designed by U.S. chipmaker Nvidia.

The investment comes as SK Hynix seeks to meet growing demand for HBM as global AI competition intensifies, a trend that has pushed up prices and made it lucrative for memory giants.

SK Hynix rival Samsung Electronics has also announced plans to ramp up HBM production in recent months.

According to industry projections cited by SK Hynix, the HBM market is expected to expand at a compound annual growth rate of 33% between 2025 and 2030.

However, the process of producing HBM memory is much more demanding than that for memory used in most consumer electronics. As chipmakers shift to meet AI-driven demand, supplies of conventional memory have tightened, contributing to price hikes and raising concerns about higher costs across the broader electronics industry.

TrendForce, a Taipei-based tech research firm, said last week that it expects average dynamic random access memory prices, including HBM, to rise by 50% to 55% this quarter compared with the fourth quarter of 2025.

Dynamic Random Access Memory, or DRAM, generally refers to the primary, volatile memory found in most computers for temporary data storage.

While higher memory prices have created challenges for electronics manufacturers, they have boosted earnings for memory producers. Samsung said last week it expects operating profit for the December quarter to nearly triple from the same period last year.

Meanwhile, SK Hynix is weighing a potential U.S. listing following a blockbuster 2025 for its shares in South Korea. The stock is up about 12% since the start of this year, though it fell roughly 2.5% in Tuesday trading.