The escalating trade war with China is currently on something of a hiatus. In October, the Trump Administration eased tensions by reversing its decision to expand the list of Chinese companies restricted from access to advanced U.S. technology. Earlier this month, Trump said he would allow Nvidia to export to China some high-grade computer chips, with the U.S. government collecting twenty-five per cent of the revenues. Wall Street seems to be tacitly assuming that the détente will last beyond Trump’s trip to China scheduled for April, but who really knows? If the government in Beijing doesn’t agree to the concessions that he wants, he could easily revert to a more coercive stance.

Even if the economy can endure another year of the Tariff Man, there are other issues that could have a big political effect. They include jobs, prices, and health-care costs. Since April, growth in employment has averaged just forty thousand jobs a month. Last year, the figure was more than four times larger. Moreover, Powell said the Fed thinks the official monthly payroll figures are overestimating the actual numbers by about sixty thousand. If that’s right, the economy has been shedding twenty thousand jobs a month. Even going by the official figures, the number of people working in manufacturing, the sector which is supposed to be the primary beneficiary of Trump’s tariffs, has fallen by sixty-three thousand this year. Other industries that have recently displayed weak hiring are information and finance, which employ a lot of white-collar workers. This has provoked fears that A.I. is eliminating jobs. In a Reuters/Ipsos poll, seventy-one per cent of respondents said they were concerned that A.I. will be “putting too many people of out of work permanently.”

Trump can’t be blamed for A.I., although the executive order that he issued two weeks ago in an effort to prevent states from regulating the potentially transformative new technology demonstrated how beholden he is to the Silicon Valley tech barons.

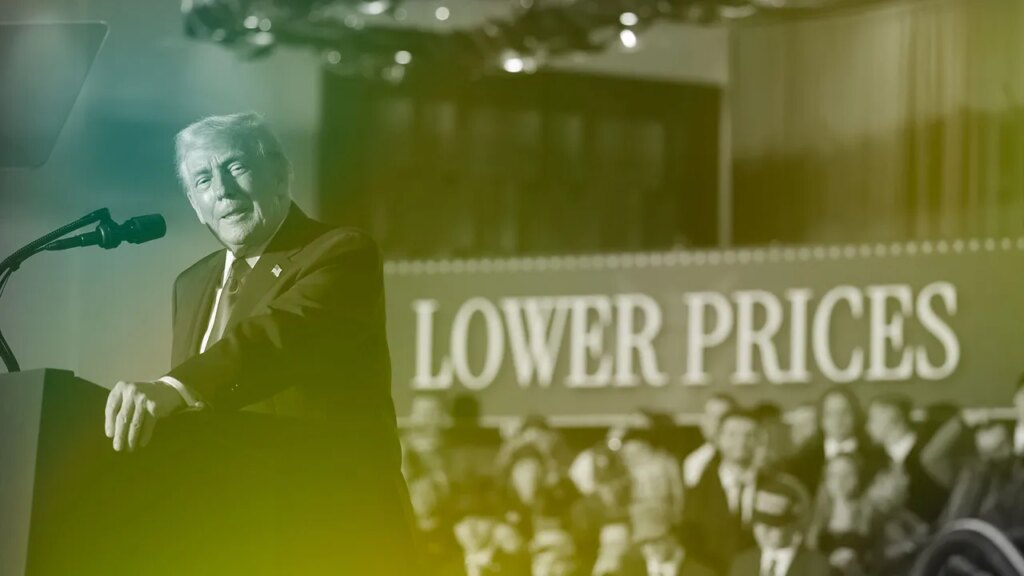

He is more directly responsible for stubbornly high prices. His tariffs have helped raise the prices of many imported goods, including grocery staples such as coffee and bananas, and his mass deportations may be producing a labor shortage in some service industries, such as restaurants and hospitality, where there were almost a million job openings in the fall. When firms are struggling to find the workers they need, they have to offer higher wages, which raises their costs.

As the midterms approach, Democrats will surely heed Barack Obama’s advice to focus on affordability, jobs, and health care. With Congress having adjourned without addressing the year-end expiry of enhanced subsidies for health-insurance policies purchased through Obamacare exchanges, some twenty-two million Americans will be affected. Going into 2026, many of them could face much higher premiums, more than double in some instances. With Republicans divided, and Trump still doing little more than publicly bashing Obamacare, there is no assurance of any resolution.

Meanwhile, Trump’s presence in the White House is accentuating another big threat to the economy, which comes from financial fragility. Over the past three years, the S. & P. 500 has risen by more than seventy-five per cent, and the Nasdaq has more than doubled. Relative to earnings, stocks are trading at very high levels, historically speaking, and investors are borrowing record amounts of money to buy these stocks. On the basis of optimistic assumptions for revenues and profits, A.I.-related companies are raising enormous sums of money, in many cases from one another. And despite the revenues from Trump’s tariffs, the U.S. government is running a budget deficit of close to six per cent of G.D.P.

Whether one categorizes this situation as a financial boom or a bubble is largely a matter of terminology. The key point is that the financial system is vulnerable to unexpected disruptions, and, as the Bank of England recently noted, the risks are rising. Conceivably, a shock could emerge from the A.I. complex, or from the private-credit sector—where hedge funds, private-equity firms, and other non-bank lenders have been expanding their lending very rapidly—or from Trump himself, as he moves to extend his power over the Fed, an institution whose independence many investors, here and abroad, regard as the primary guarantor of financial stability. Powell’s term as Fed chair ends in May, and Trump is set to announce a replacement early in the New Year. Kevin Hassett, who heads the National Economic Council at the White House, and frequently appears on television defending Trump’s policies, is the favorite to get the job—despite rumblings on Wall Street that he would be too much of a patsy.