Introduction: UK house price tipped to rise 2%-4% in 2026

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

With the year almost over, thoughts are lightly turning to what might happen in 2026.

And lender Nationwide is predicting that UK house prices will climb by up to 4% next year, as getting onto the housing ladder becomes slightly less difficult.

In their Outlook for 2026, Nationwide’s chief economist Robert Gardner predicts that lower borrowing costs could help the market in the 12 months ahead, saying:

“Looking ahead, we expect housing market activity to strengthen a little further as affordability improves gradually (as it has been in recent quarters) via income growth outpacing house price growth and a further modest decline in interest rates.

We expect annual house price growth to remain broadly in the 2 to 4% range next year.

The next decline in interest rates could come as early as this Thursday, when the Bank of England is generally expected to lower its key interest rate from 4% to 3.75%.

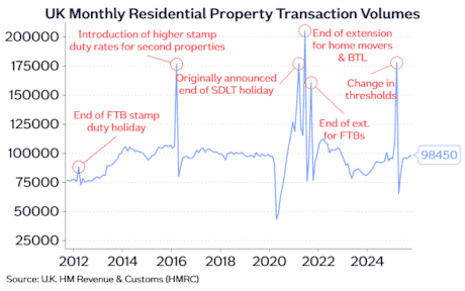

Gardner suggests that chancellor Rachel Reeves’s new taxes on the top of the property markets are unlikely to have a major impact on prices in 2026 – but new levies on landlords could make it pricier to rent”:

“The changes to property taxes announced in the Budget are unlikely to have a significant impact on the market. The high value council tax surcharge is not being introduced until April 2028 and will apply to less than 1% of properties in England and around 3% in London.

The increase in taxes on income from properties may dampen buy-to-let activity further and hold down the supply of new rental properties coming onto the market, which could in turn maintain some upward pressure on private rental growth.”

Looking back over the last year, Gardner reminds us that annual price growth slowed steadily from 4.7% at the end of 2024 to 2.1% in the middle of 2025 and then to 1.8% in November.

This has left prices close to the all-time high recorded in the summer of 2022.

The agenda

Key events

Tom Knowles

First-time buyers are taking out larger mortgages than ever before as rising wages and looser affordability tests allow them to buy properties that were previously beyond their budget.

The average first-time buyer borrowed £210,800 in the year to September, a record high, according to analysis by Savills, the property agent.

First-time buyers accounted for 20% of all spending in the UK housing market in the 12-month period, which is the highest level since at least 2007, it added. More here.

Rightmove predicts 2% bounce in prices, and a busy Boxing Day

Property portal Rightmove has also predicted house prices will rise next year, as budget uncertainty fades away.

It predicts that the price tag on houses being put up for sale will increase by 2% in 2026, as “buyer affordability is set to improve”, helping to put upward pressure on prices.

Rightmove is now anticipating a bigger-than-usual Boxing Day bounce on its platform, as many of those who paused their plans due to Budget uncertainty join the traditional start of the busier home-moving season.

Colleen Babcock, property expert at Rightmove, says:

“Lower price growth supported buyer affordability and drove activity in the first half of the year, even after the April stamp duty deadline in England. In the second half of 2025, uncertainty caused by rumours of property tax changes in November’s Budget swirled, some from as early as August.

This had an impact on pricing and activity, as sellers tried to entice nervous buyers. The market will soon benefit from the traditional boost in home-moving activity from Boxing Day. Rightmove’s Boxing Day Bounce is an annual event where we see many begin or resume their plans to move after the distraction of Christmas.

With the turkey and trimmings barely off the table, each year we see people heading straight to Rightmove to browse the fresh listings for sale and imagine how different next Christmas could look.”

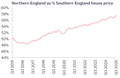

North-South house price divide narrowest since 2013

Natiowide also reports that the price gap between houses in the more expensive south and the cheaper north of England has shrunk to a 12-year low this year.

This was partly due to the London housing market lagging behind.

Nationwide explains:

London was the weakest performing region in the first nine months of the year with annual growth averaging 1.3%.

This was part of a wider trend that saw house price growth in the northern regions of England outpacing the southern regions. As a result, the price differential narrowed to its lowest since 2013. The average price of a home in northern regions of England is now almost 58% of that in the southern regions, well above the lows of c48% seen in 2017.

Introduction: UK house price tipped to rise 2%-4% in 2026

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

With the year almost over, thoughts are lightly turning to what might happen in 2026.

And lender Nationwide is predicting that UK house prices will climb by up to 4% next year, as getting onto the housing ladder becomes slightly less difficult.

In their Outlook for 2026, Nationwide’s chief economist Robert Gardner predicts that lower borrowing costs could help the market in the 12 months ahead, saying:

“Looking ahead, we expect housing market activity to strengthen a little further as affordability improves gradually (as it has been in recent quarters) via income growth outpacing house price growth and a further modest decline in interest rates.

We expect annual house price growth to remain broadly in the 2 to 4% range next year.

The next decline in interest rates could come as early as this Thursday, when the Bank of England is generally expected to lower its key interest rate from 4% to 3.75%.

Gardner suggests that chancellor Rachel Reeves’s new taxes on the top of the property markets are unlikely to have a major impact on prices in 2026 – but new levies on landlords could make it pricier to rent”:

“The changes to property taxes announced in the Budget are unlikely to have a significant impact on the market. The high value council tax surcharge is not being introduced until April 2028 and will apply to less than 1% of properties in England and around 3% in London.

The increase in taxes on income from properties may dampen buy-to-let activity further and hold down the supply of new rental properties coming onto the market, which could in turn maintain some upward pressure on private rental growth.”

Looking back over the last year, Gardner reminds us that annual price growth slowed steadily from 4.7% at the end of 2024 to 2.1% in the middle of 2025 and then to 1.8% in November.

This has left prices close to the all-time high recorded in the summer of 2022.