The year 2025 was not just another year for Indian equity markets; it was a year of learning, especially for new investors. Many who entered the markets after Covid had seen only rising prices. Stocks were not merely going up by 10 or 20 per cent; many were rising five, ten, even twenty times. This created a belief that markets only move in one direction and that any stock bought at any price would eventually make money.

That belief turned out to be the biggest behavioural mistake retail investors made.

I recall being asked at an investor event in late 2024 how one could improve returns after already earning 30 per cent CAGR for four years, when others were making 40–50 per cent. That was a wake-up call. When investors are dissatisfied with such strong returns, expectations have clearly moved far away from reality.

Markets, like nature, operate in cycles. There are periods of optimism and periods of correction, just as there are seasons of growth and slowdown. It is not possible to earn 30–40 per cent every year for decades. The correction and consolidation seen in 2025 were therefore necessary. They helped restore balance and perspective. Investors who understand this will be better prepared for the years ahead.

2026: A selective market where earnings matter

As we move into 2026, markets are likely to become far more selective. The phase when almost every stock rose together is over. Going forward, companies that show clear growth in business and profits will be rewarded, while those without earnings visibility will remain under pressure.

This does not mean that markets must fall sharply from here. Many stocks have already corrected 50–70 per cent from their highs. What is more likely is a phase of consolidation, where prices move in line with fundamentals rather than expectations.

Earnings are once again taking centre stage. In recent years, stock prices often moved on announcements and stories, even when profits were still years away. That approach is no longer working. In 2026, earnings growth is likely to be selective rather than broad-based.

Margin expansion across sectors may remain limited, but revenue growth will be important. Companies that grow their sales by 15–20 per cent, even with stable margins, can still see steady profit growth through scale. Investors should therefore focus on businesses where sales growth and visibility are clear, instead of chasing short-term margin gains.

Technology-led change is another area where investors need to be careful. Businesses that fail to adapt to changing consumer behaviour or new trends risk losing relevance. In today’s environment, the inability to change is often a bigger risk than competition itself.

India’s growth challenge

At the macro level, India’s long-term prospects remain strong, but challenges cannot be ignored. While 7–8 per cent GDP growth looks healthy, it is not enough if India wants to compete with the world’s largest economies. To catch up with countries like China, the country needs sustained double-digit growth.

This will not be possible without a strong push in manufacturing and infrastructure. Unemployment remains my biggest concern. India needs to create 80 lakh to one crore new jobs every year. With automation and artificial intelligence leading to job losses globally, this challenge will only become more serious.

Manufacturing is the only sector that can generate employment at scale. Policy measures such as PLI schemes are steps in the right direction. Budget 2026 should continue to focus on manufacturing and infrastructure to support long-term growth and job creation.

The discipline of long-term investing

For new investors, self-reflection is essential. Understand what worked, what failed, and why. Avoid investing in businesses you do not understand. Larger allocations should be made only where conviction is supported by visibility. Learning from others is useful, but investing without developing one’s own approach rarely leads to lasting success.

Ultimately, successful investing requires the mindset of a marathon runner, not a sprinter. Long-term investing does not begin after a few months or a couple of quarters, it begins after five years and extends much further. Bull markets often create overconfidence, while corrections bring discipline. Investors who respect cycles, remain patient, and value balance are the ones who create wealth over time.

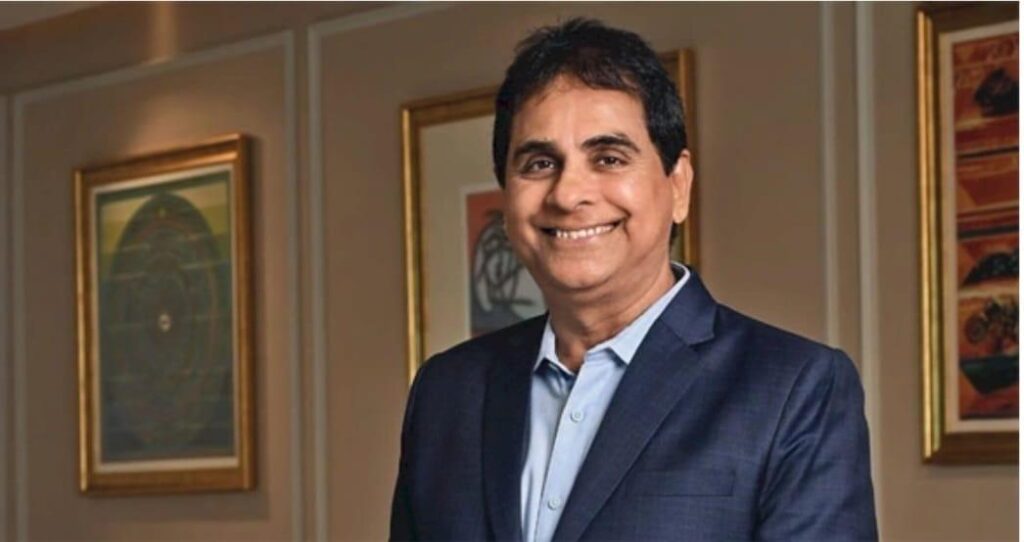

(Disclaimer: Vijay Kedia is a private investor. Views expressed are his own.)