By Lucia Kassai, Jennifer A. Dlouhy and Robert Tuttle

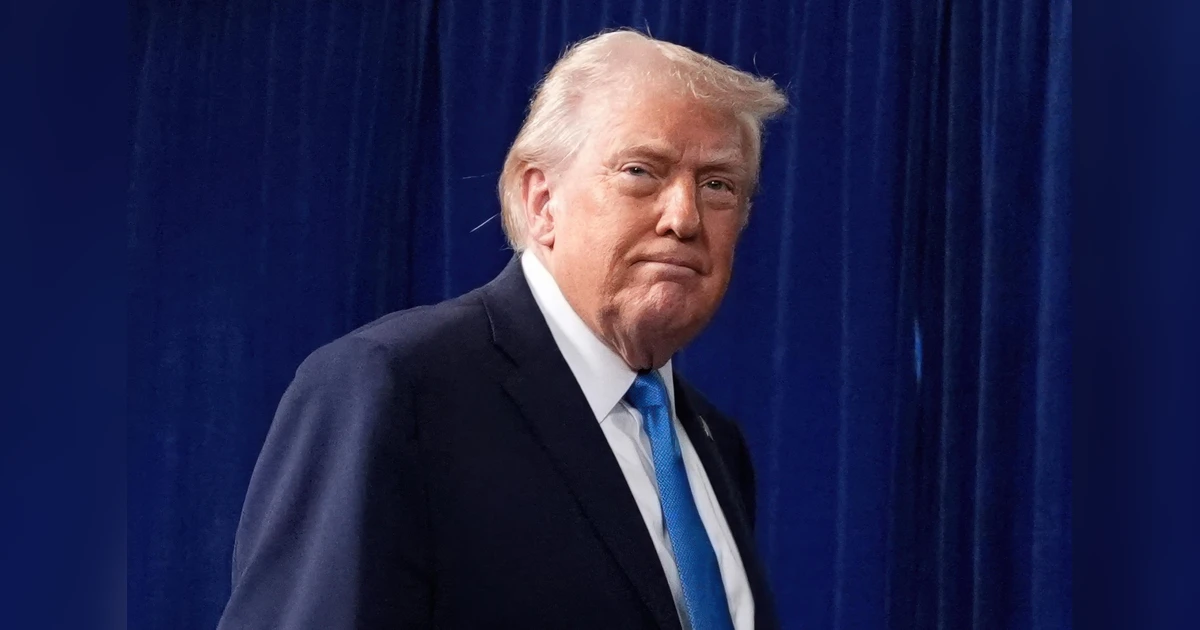

Realising President Donald Trump’s plan for a US-led revival of Venezuela’s beleaguered oil industry could be a years-long and challenging process costing upwards of $100 billion.

Years of corruption, underinvestment, fires and thefts have left the nation’s crude infrastructure in tatters. Rebuilding it enough to lift Venezuela’s output back to its peak levels of the 1970s would require companies that could include Chevron Corp., Exxon Mobil Corp. and ConocoPhillips to invest about $10 billion per year over the next decade, said Francisco Monaldi, director of Latin American energy policy at Rice University’s Baker Institute for Public Policy.

“A faster recovery would require even more investment,” Monaldi said.

Venezuela sits atop the world’s largest oil reserves. But output plummeted during the 12-year term of President Nicolás Maduro, who was captured early Saturday by US troops. The nation currently produces about 1 million barrels a day, compared to nearly 4 million barrels in 1974.

US Secretary of State Marco Rubio said during an interview with ABC Sunday that he expects US oil companies will be eager for the opportunity to drill for Venezuela’s heavy crude, which is key for refineries on the US Gulf Coast.

Yet before they set foot in Venezuela, companies will want to be certain it’s stable, according to Lino Carrillo, a former manager at the nation’s state oil company, Petroleos de Venezuela SA, who fled the country more than two decades ago.

“For any oil companies to actually get serious about investing in Venezuela would require that there will be a new congress or National Assembly,” Carrillo said in an interview. “Not what’s happening now. Definitely not.”

The work needed to repair the nation’s infrastructure, meanwhile, is vast.

At Venezuela’s oil ports, the equipment is in such poor shape that it takes up to five days to fully load supertankers that deliver crude to China. Seven years ago, it took just one day.

In the Orinoco Basin, a huge swath of Venezuela’s interior that’s estimated to hold nearly a half a trillion barrels of recoverable oil, rigs have been abandoned and spills go unchecked. Drilling pads have been ransacked in broad daylight and sold for parts on the black market.

The country’s sprawling network of underground pipelines is notoriously leaky and, at times, has been pillaged by the state oil company and sold as scrap metal. Fires and explosions have gutted equipment.

And the massive Paraguana oil refining complex on the coast northwest of Caracas operates only intermittently and at low rates due to breakdowns. Some of its four oil upgraders, once state-of-art facilities that pre-treat the country’s tar-like crude into feedstock suitable for refineries, have shuttered.

What’s left of Venezuela’s production relies heavily on Chevron, the only major US oil company still operating in the country. The Houston-based company accounts for about 25% of the nation’s output, working under a special licenses that allows it to remain there despite US sanctions.

The other two US companies that would be best positioned to help rebuild Venezuela, given their size and experience, are Exxon and ConocoPhillips, analysts said. Both worked there previously but left after their assets were nationalized by Maduro’s predecessor, the late Hugo Chavez, in the mid-2000s.

Exxon and ConocoPhillips didn’t respond to requests for comment. Exxon has previously said it would look at investing in Venezuela but only under the right conditions.

It remains far from certain how Venezuela’s political transition will unfold and what the environment will be like for oil companies to operate. For now, sanctions remain in place, and a US naval blockade controls the surrounding waters. Trump has said Vice President Delcy Rodriguez is now in charge, even though she is a staunch ally of Maduro.

“I expect oil companies will start the work of updating plans and proposals for their participation — but won’t make commitments until basic political stability looks forthcoming,” said Clayton Seigle, a senior fellow at the Center for Strategic and International Studies in Washington.

The Trump’s administration’s work to assess Western oil companies’ interest is falling partly to Interior Secretary Doug Burgum and Energy Secretary Chris Wright, the chair and vice chair of Trump’s National Energy Dominance Council.

Another challenge for companies to invest in Venezuela production is the fact that the world is awash with oil, and global prices are hovering near a five-year low. Many companies, meanwhile, are still owed billions of dollars in unpaid loans and compensation after their assets were seized under Chavez.

But oil companies may still be lured back if the price and risk premiums are right, said Kevin Book, managing director at Washington-based ClearView Energy Partners.

“You’re going to need good terms to get around heroic uncertainty,” Book said in an interview. “The kinds of companies that are capable of profitably producing resources in Venezuela are unlikely to ignore the size of the reserve opportunity if they can see signs of relatively stability and they can secure favorable contract terms.”