Ber Mitchell is an international investor whose experience spans real estate, digital assets, and multiple global market cycles. Having operated through periods of rapid expansion and sharp contraction, Mitchell has developed a philosophy rooted not in chasing upside, but in protecting capital through disciplined structure, risk awareness, and long term positioning.

For much of modern investing history, alpha was defined by excess return. The ability to outperform benchmarks and capture upside became the dominant measure of success. Today, that definition is quietly changing. In an environment marked by geopolitical uncertainty, rapid monetary shifts, and increasingly correlated markets, the ability to preserve capital has become just as valuable as the ability to grow it.

This shift reflects a deeper understanding of how wealth is actually built.

When Growth Becomes Fragile

Periods of strong performance tend to obscure risk. When markets rise consistently, volatility feels distant and drawdowns appear manageable. Investors become conditioned to focus on returns while underestimating the structural weaknesses that emerge beneath the surface.

History shows that losses carry more weight than gains. A portfolio that loses forty percent must gain more than sixty percent simply to recover. Capital destruction compounds faster than capital growth, making preservation a prerequisite for long term success.

Mitchell views this asymmetry as the starting point of modern investing. Rather than asking how much an asset can return, the more important question becomes how much it can lose and under what conditions.

Preservation as an Active Discipline

Capital preservation is often misunderstood as passivity. In reality, it requires constant engagement, assessment, and adjustment. Preserving capital does not mean avoiding risk entirely. It means assigning risk deliberately and understanding its role within a broader system.

Mitchell emphasizes that preservation begins with structure. Diversification alone is not enough if assets respond similarly during periods of stress. True protection comes from combining assets with different drivers, liquidity profiles, and time horizons.

This approach shifts the focus from maximizing upside in a single cycle to sustaining participation across many cycles.

The Role of Liquidity and Optionality

One of the core elements of capital preservation is liquidity. Assets that cannot be exited under pressure expose investors to forced decisions. Liquidity provides optionality, allowing capital to be repositioned rather than trapped.

Modern markets often blur the distinction between value and liquidity. Assets may appear valuable during favorable conditions, yet become illiquid when sentiment shifts. Preservation strategies account for this gap by prioritizing assets that retain transactional depth even during periods of uncertainty.

Optionality is equally critical. Portfolios designed with multiple paths forward reduce dependence on any single outcome. This flexibility allows investors to respond to changing conditions without sacrificing long term objectives.

Rethinking Risk in a New Environment

Risk is frequently framed as volatility, but volatility alone does not define danger. Permanent loss of capital does. Mitchell’s perspective reframes risk as the probability of irrecoverable outcomes rather than temporary price movement.

This distinction matters in a world where information travels instantly and reactions accelerate. Short term fluctuations are inevitable. Structural fragility is not.

By focusing on downside exposure and recovery potential, investors gain a clearer view of whether an opportunity aligns with their long term goals.

The Institutional Influence

Institutional investors have long understood the importance of preservation. Pension funds, endowments, and sovereign entities prioritize survival and consistency over headline performance. Their success lies in avoiding catastrophic losses rather than chasing peak returns.

What is changing is accessibility. Individual investors now operate in markets once dominated by institutions, yet often without the same frameworks. Mitchell’s approach translates institutional discipline into practical strategies that individuals can apply.

This includes separating growth assets from defensive assets, managing leverage conservatively, and maintaining clear criteria for rebalancing and exit.

Preservation Enables Compounding

The power of compounding depends on continuity. Capital that avoids major drawdowns compounds more effectively over time, even if annual returns are modest. Preservation protects the base upon which growth accumulates.

Mitchell views this as the foundation of sustainable wealth. Short term outperformance means little if followed by long recovery periods. Steady participation across cycles produces results that speculation rarely matches.

In this context, preservation becomes the new alpha. It does not attract attention during bull markets, but it defines outcomes when conditions change.

A Shift in Investor Mindset

The modern investment landscape rewards those who adapt. Capital preservation is no longer a defensive posture reserved for late stages of wealth. It is a proactive strategy that enables longevity, flexibility, and clarity.

As markets grow more complex, the ability to endure becomes a competitive advantage. Investors who prioritize preservation position themselves to deploy capital when opportunities are most compelling rather than when enthusiasm is highest.

The evolution of alpha reflects a broader maturity in how success is measured. It is no longer about how aggressively capital is grown, but how intelligently it is protected.

In a world where volatility is constant and certainty is rare, capital preservation is not the absence of ambition. It is the discipline that allows ambition to endure.

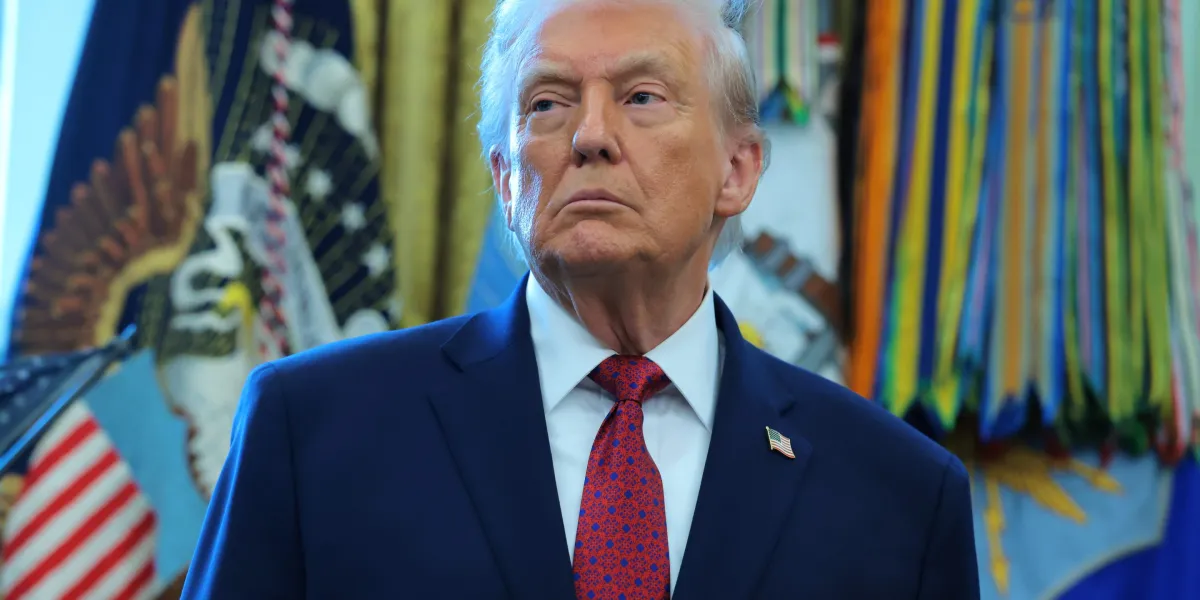

The photo in the article is provided by the company(s) mentioned in the article and used with permission.

Disclaimer: This article contains sponsored marketing content. It is intended for promotional purposes and should not be considered as an endorsement or recommendation by our website. Readers are encouraged to conduct their own research and exercise their own judgment before making any decisions based on the information provided in this article.